All of the actions of the Assessing Department set the value of the city for both real and personal property in a fair and equitable manner to distribute the tax burden. Nearly everyone feels the burden of paying taxes, either directly or indirectly. Therefore, it is important to demonstrate both an equitable and understandable system for determining property value and the true costs of government, which are the basis for property tax action. Local property taxes generate the income used to help finance and support all aspects of the city including:

- Schools/Education

- Public Safety – Police, Fire & Ambulance

- Library

- Roads & other infrastructure repairs

- Harbor/waterfront, parks & recreation

- Solid waste management

- City Hall services

- County services

For property owners the one or two large property tax payments each year feel more painful than sales tax, which is paid in small amounts every time you make a purchase, or income tax, which is paid weekly or biweekly in payroll deductions. Therefore, it’s important for property owners to understand how their tax rate (or mil rate) is determined in order to better articulate the value of services their tax dollars buy. Property tax is applied to the value of properties by April 1st each year. Maine law requires the tax assessor to determine property value as accurately and equitably as possible based on its “just value” or fair market value. This is determined through the following:

- Cost approach - what the building replacement or reproduction new minus the depreciation appropriate to the property.

- Market data/sales approach - estimating the market value of a given property by comparison with other similar properties in the same vicinity, which have sold recently on the open market. Differences in the properties must be taken into account.

- Income approach - used in the valuation of investment properties and other similar properties and utilizes the net income generated by the property to develop a value.

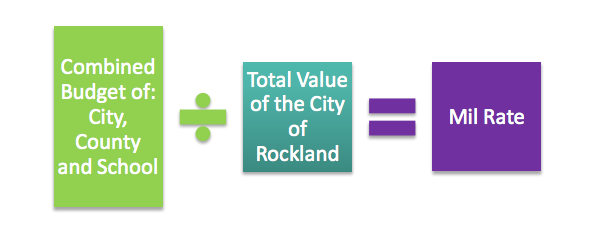

Each mil on the property tax rate represents $1.00 in taxes for every $1,000 in property value. Therefore, if your home is valued at $150,000 and the mil rate is $20, your tax bill will be $3,000. If the mil rate were $15 you would pay $2,250.

While determining the value of property and the tax rate may seem straight forward there are a number of factors that must be taken into consideration including:

- Personal property – machinery, equipment, computers, furniture, fixtures, etc. owned by businesses that are subject to tax but may be exempted or reimbursed through the State Government BETE & BETR programs.

- Tax exemptions – including the homestead exemption, veteran exemption, widow, widower, minor child or widowed parent of a veteran exemption, blind person’s exemption.

- All of the functions deed transfers, updating of owner information, exemptions, sales ratio analysis all provide the data to be able to complete an equitable and just valuation of real and personal property in the city.

When it comes to generating income for the City of Rockland, the Assessing Department is the backbone. If the valuations are too low or too high, it could lead to many significant issues in the city. This would impact tax collection, liens, tax payer contact info, state valuation, reimbursement of BETE, homestead, veterans and all other exemptions. In the event that the valuations were deemed indefensible, it would create litigation that is costly and time consuming. As an example in the past there was an abatement request for over $2.5 million. A month of research and requesting supporting documentation, answering emails, meetings etc. was put into the refutation of the request, which the City successfully defended.

Fair market value of property is the only method that the city has to apportion the costs of local government, schools and county government fairly.