The City of Rockland, Maine has contracted with Vision Government Solutions to provide Revaluation Services for the assessment date of April 1, 2025. The project will begin in early September 2023, with data collection beginning in February 2024. The data collection will be completed in every area of the City, but will be concentrated in one particular area at a time. You will be notified via mail when a data collector will be in your area and the Vision Government Solutions employees will have proper identification and their vehicles will be registered with the Police Department. If a homeowner wants further confirmation, they may call the Assessor’s Office. If you have taken out a Building Permit, or there are other changes to your property, additional data collection will be necessary. The new assessment notices will be mailed the end of May 2025 with hearings beginning right away through June 2025. The project will be completed in July 2025 and tax bills will be mailed late August 2025.

If you have any questions, please contact the Assessor by phone (594-0303) or email (mbennett@rocklandmaine.gov).

Announcements

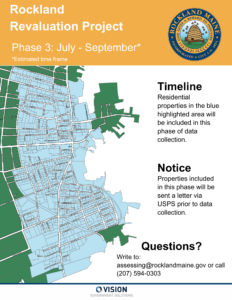

Phase 3 of the Revaluation Project begins in July.

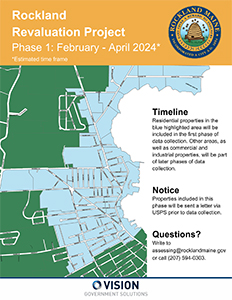

Please click the image for a larger version.

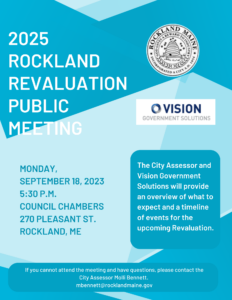

Click on the image for a larger version of the flyer.

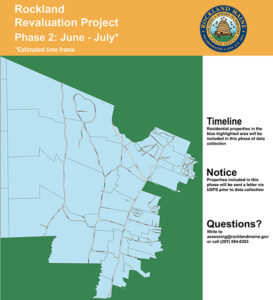

Phase 2 of the Revaluation Project will begin in June.

Please click the image for a larger version.

Click the images for a larger version.

Press Release - Data Collection - 2/6/2024

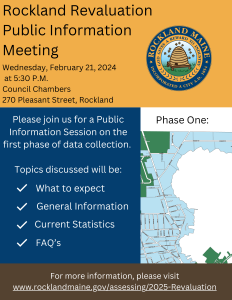

The first phase of data collection will begin February 2023. This is the first area of data collection.

Public Meetings

Wednesday, February 21, 2024 @ 5:30 pm in the Council Chambers

Public Information Meeting - Beginning Data Collection for the Revaluation

https://livestream.com/rocklandmaine/events/11090729

Press Release - Data Collection - 2/6/2024

September 18, 2023 - Public Information Meeting

https://livestream.com/rocklandmaine/events/10958932

2025 Revaluation FAQs

This section is to answer some of the frequently asked questions about the 2025 Revaluation. If you do not find the answer here please feel free to call us or ask your question online.

No. A revaluation is a revenue-neutral process. It’s about fairness. The revaluation redistributes the existing tax burden based on current values. The City only collects the taxes necessary to meet the approved budget payments for the City, School, and County Budgets.

You do not have to let the Assessor or Data Collector into your home. If you refuse entry, you will receive a 706-A request letter with questions about your property. If you do not respond to the request with the asked-for information or within the time frame required, the City will need to estimate your assessment, and you lose your right to appeal (as seen in this 706-A definition).

If you think your assessment is too high after receiving the new assessment letter, you may schedule an appointment for a hearing. There you will be able to say why you think the assessment is too high, and adjustments will be made if necessary.

If the assessment is considered accurate, and you still disagree with the assessment you can file an Abatement Application during the abatement window of 185 days from the commitment date (the date at which assessments are finalized). Commitment is typically in August.

A Revaluation’s goal is to distribute the tax burden fairly—to ensure that no one taxpayer pays more or less than their fair share. The process includes data collection and market analysis to develop assessments that are consistent with Just Value (another way of saying Market Value).

The first and longest step of the revaluation is Data Collection. Data Collectors visit each property to collect data. The Data Collector will also ask for an interior inspection, but you do not have to agree to it. After Data Collection, the City will analyze recent property sales in Rockland. Base rates will be developed using a combination of three approaches to value (cost, market/sales, and income approaches), and applied to your property. Valuation letters are then mailed to property owners with information about their new assessment and how to schedule a hearing to discuss the assessment. When this process is complete, taxes will be finalized based on the assessed values set by the revaluation.

State law requires a revaluation every ten years. Rockland’s last full revluation was completed in 2005 so it’s long overdue. Over the past decade the market value of property has increased, which caused the ratio of assessed value to sales price to grow out of alignment. When this “Assessment Ratio” falls below a certain percentage, the State reduces many reimbursements and exemptions, among other things. This means that our homeowners aren’t getting the full value of exemptions they are entitled to such as the Homestead and Veteran’s exemptions.

No. In a revaluation, typically the overall valuation of the City increases – which means a lower mil rate (tax rate) is needed to collect the same amount of revenue for City, County, and school expenses. (The amount the mil rate decreases can’t be calculated until the revaluation and commitment is completed).

In a typical revaluation, about 1/3 of property owners’ taxes go up, about 1/3 remain the same, and about 1/3 go down. All else being equal, your taxes will only go up if your valuation went up more than the average valuation. If your property value went up less than average, or by an average amount, then your taxes will go down or stay the same.

The overall goal of Data Collection is to gather information to ensure each property owner is paying their fair share of taxes. The Assessor is required to assess each property within their municipality. If the Assessor is unable to inspect the interior of a building, they will do their best to estimate interior details and the interior condition of the building but will be missing key data that is important in producing an accurate assessment.